A Typology of Flexible Loan Structures for Microenterprise Lending: Balancing Sustainability and Client Needs

Main Article Content

Abstract

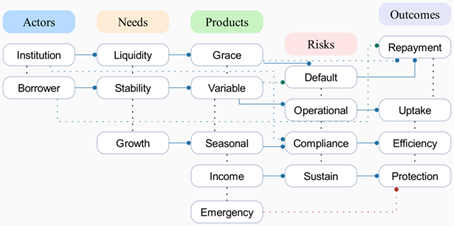

The absence of a financially sound loan product that addresses the financial and seasonal/ irregular income needs of the smallholder farmer is part of the perennial challenge microfinance institutions face. This is then by a more nuanced typology of the range of flexible loan products that we have identified herein, which has been guided by a synthetic view of the extant microcredit literature, credit management theory and our analysis of microenterprise operation. The review achieves this by diagnosing the available `flexible mechanisms' (grace periods, flexible amortization, and seasonal balloon payments) in a holistic means to underwrite their risk profile, transaction cost, and micro-enterprise viability. We demonstrate via our analytical model and risk simulations scale of the portfolio showing a boost of the portfolio creditworthiness would not significantly increase the portfolio institutional default risk or administrative complexity if the loans are structured to repay every step period in alignment with borrowers' income cycle. The typology that emerges is thus a set of features that can be used to link features of loans to operating context and borrower characteristics, features that can be employed by practitioners and policy-makers in designing products that work as building blocks in the direction of client-protection and financial well- being. The diagnostic is the core of how evidence-based lending innovation is driven and the foundation for designing sustainable, inclusive enterprise financial services to serve those who live in worlds of irregular cash flows.

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.