Bridging Distribution Gaps: A Conceptual Framework for Microinsurance Delivery to Remote Subsistence Farmers

Main Article Content

Abstract

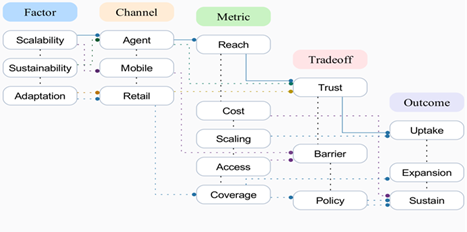

The crushers have put some premium for the risk entailed and risk information is a key input which further magnifies the disadvantages for this group of farmers of this lack of access to risk management services, even in the best of circumstances that without payments linked with their poor resilience precautions, it is difficult to see why Micro-insurance suppliers (MIFIs, PTCs) would serve these farmers. The barriers for MI suppliers implemented before assimilation and ease of access of insurance also includes the challenges of bad structure for distribution without infrastructure, trust and too high transaction cost. To make up for service delivery constrains in rural areas, we develop a holistic approach that does not only consider multi-channel means, involving agents, mobile banking and partnership with local retailers, but also, we reflect on the strategically designed infrastructure through which these suppliers concurrently reach their end users. While drawing on thoughts from financial inclusion, microfinance and risk management-associated fields, the model builds on, and organizes current thinking about outreach mechanisms, by categorizing them in a coherent manner and by illustrating trade-offs, synergies and scaling-up potential between channels. The analysis contains a typology of delivery models, synthesis of best practice policy and hypotheses for local adaptation on issues of geography, literacy, digital adoption, affordability, and risk pooling. The service availability and its potential for expansion are estimated by using measures such as channel reach (index), cost-to-serve (ratio) and service availability (index). Some important findings emphasize the efficacy of locally embedded integrated responses in overcoming structural constraints to financial inclusion and (for) the success of microinsurance. The key contribution is a pragmatic guide tailored to both practitioners and policymakers on how to effectively expand microinsurance to the left behind farmers through gender-integrated and adaptable distribution channels.

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.