Mapping Operational Efficiency Frameworks for Microinsurance Delivery to Rural Farmers

Main Article Content

Abstract

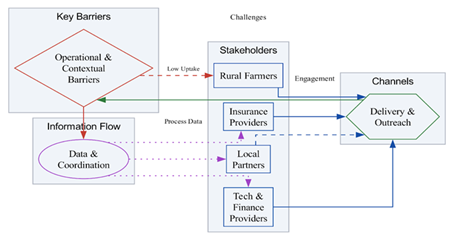

Microinsurance can potentially enhance the financial inclusion of rural maize farmers in low-income countries such as Malawi, where transaction costs and operational inequities are a significant limitation. This study contributes to a structural mapping and analysis of the various conceptual models used to overcome these constraints for the operationalization of the microfinance institution to deliver the microinsurance to unbanked farmers. Drawing from theoretical constructs of service operations, value chain development, and decentralized service delivery, it generalizes a series of design guidelines for best practice product, policy, and outreach design from open-source case data. Ease of use, stakeholder alignment and product functionality constituent modularity are also identified in the models as critical factors for the reduction of complexity and cost and the enhancement of client relevance and adoption. Flexible taxonomies to minimize administrative costs are identified from the analysis and practical process models are developed for scaling and long-term sustainability of microinsurance schemes. Implications: Findings highlight policy levers and institutional adjustments required to maintain efficiency improvements and innovations in this area, providing a roadmap to improve access to affordable products for vulnerable agrarian communities. The primary product consists of a set of operational frameworks and policy options that will be useful to researchers and practitioners focused on pursuing inclusive finance in rural areas.

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.