Mapping Resilience Pathways: A Conceptual Framework for Portfolio Risk Management in Microenterprise Lending During Economic Shocks

Main Article Content

Abstract

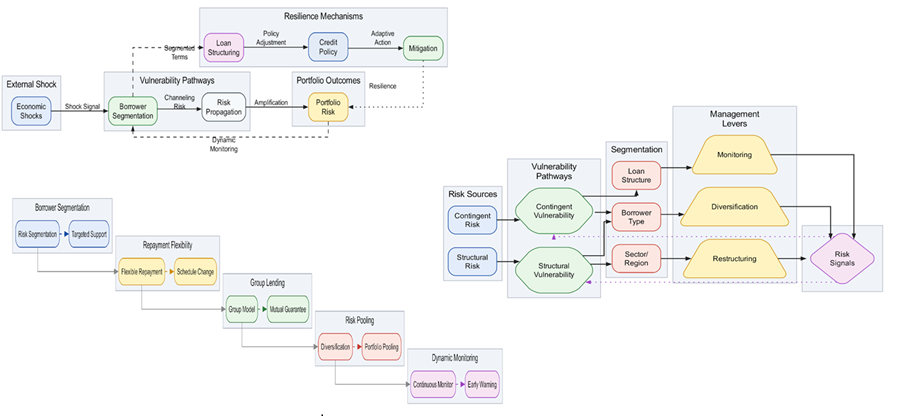

High rates of default and irregular rates of repayment remain critical constraints on MFIs, particularly when lending to vulnerable rural clients that are also affected by recurrent systemic shocks including crop failure. The paper models risk contagion across a lending portfolio as a spread of risk following an economic or credit shock based on the lending portfolio of a microfinance institution, and develops channels of resilience through borrower segmentation, adaptive loan structuring and dynamic credit policy. This framework, which is grounded in an extensive review of the literature on risk and risk management in microfinance across different sub-fields, distinguishes between structural and contingent vulnerabilities and aggregative best practices: risk pooling, repayment flexibility, group lending and segment-based intervention. It discusses easily communicable indicators, including para portfolio-at-risk ratios, para repayment regularity indices, para segmented default comparisons, and para stress-test results, and their value in early-warning signals and trigger management. The model provides a taxonomy of intervention strategies based on the rationality of interventions with respect to at-risk borrower segments and impact mitigating effects of adverse scenarios and allows to track the performance of the on-health reflection. The foremost contribution of the study is a generic risk management framework that will enable microfinance institutions to implement evidence-based resilience strategies anchoring their financial sustainability and development performance, particularly in crisis-prone, rural landscapes.

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.