Mapping Conceptual Frameworks for Real Time Fraud Risk Management in Digital Microfinance

Main Article Content

Abstract

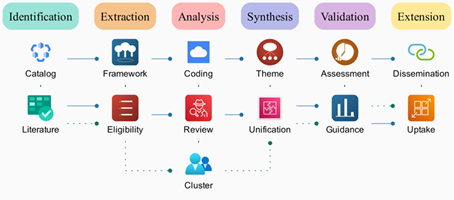

Yet the boom in digital financial services has also resulted in deeper financial inclusion, but also greater exposure to fraud and cyberthreats — particularly for digital banks and microfinance providers operating in high-transaction, low-infrastructure contexts. We systematically chart the argument-theory that constitutes real-time fraud risk management in digital microfinance, featuring digital know your customer (KYC), large scale transaction-monitoring and adaptive risk-stratification. By way of a mapping systematic literature review, the study weaves together insights from transaction theory, digital trust models, and regulatory compliance strategies to identify organizing principles to overcome the tension between access and fraud risk. These captured and harvested circular contributions led, other than repeatedly identified obstacles for practical utilization such as integration barriers and scaling issues, to insights on what to do and how, to problematic deployment in a context-agnostic way. The results create best practice strategies and policy-relevant recommendations that are critical to resolving issues of trust and safeguarding clients. The primary original contribution is through a solid, absorptive experiential model towards the formation of fraud prevention interventions in digital microfinance that underpin institutional trust and financial service inclusion.

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License.