Unpacking Trust-Building Mechanisms in Financial Literacy Initiatives for Urban Micro Enterprises

Main Article Content

Abstract

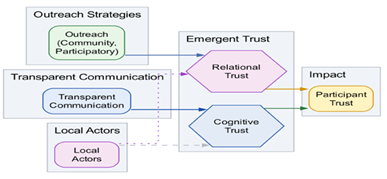

The tendency to be distrusting and also fear of extra costs (surprise charges) act as hindrance to the take-up of formal savings even by urban micro enterprises such one belonging to small shop keepers. This study intends to explore the trust formation process of financial literacy activities and outreach programs in the networks using integrative conceptual modelling and taxonomy development. More specifically, based on literature on social capital, service transparency, face-to-face interaction and make parting from developed theories around social capital (2) service transparency (3) face-to-face interaction and we have increased our aggregated model to off-line and hybrid trust engines we structure on trust in the user is examined with a specific attention on the effect of local context financial education, clarity of fees communication and market trusted local actors involvement. The work then elaborates a typology that distinguishes cognitive and relational trust to illustrate how these dimensions correspond with practices of inclusive service delivery and engagement. Key performance indicators are trust before and after intervention, percentage of participation in the program, satisfaction among Index users, perception of transparency in order to improve the program. The framework provides practical guidance to FSPs and policymakers, particularly practical and policy pathways to augment demand among 'micro-entrepreneurs' for formal savings, and provides a basis for continued refinement in institutional and customer-led design.

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.