Bridging Financial Literacy and Credit Confidence: A Theoretical Model for Ongoing Client Engagement in Rural Microenterprise Lending

Main Article Content

Abstract

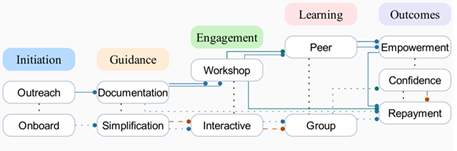

Low financial capability poor among rural microentrepreneurs particularly women led firm constrain efficient capital loan and continuous repayment of loan. In this regard, so that we can take the role of the two adopter functions of financial literacy support and continued client education as well as business advisory support to the fore in the microenterprise cooperative bank lending process of this research, a comprehensive theoretical model is developed. Leveraging existing theory on adult learning and the theoretical premise for relational banking, the model outlines a de-mystified approach to engagement, which consists of, supports documentation simplification, interactive savings workshops/initiatives, peer leaning circles enabled through documentation simplification, intended to boost credit confidence and reduce entry barriers to the codependent clientele relationship with formal finance still remains fragile. Credit Union should play some role, by the feedback we design an embedded channel-advisory to guide from a flow to a flow while increasing transparency and learning from the process. The desired outcomes from the intervention would be improved repayment discipline, optimum utilisation of a loan and enhanced literacy of money or finance and are critical for rural women borrowers. By articulating a stimulating theoretical lens based conceptual framework (and not by means of an empirical case study), this article offers practical lessons to practitioners and policy makers that seek to promote enterprise sustainability and inclusive financial systems.

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.