Mapping Pathways for Financial Product Innovation: A Conceptual Framework for Reaching Unbanked Populations

Main Article Content

Abstract

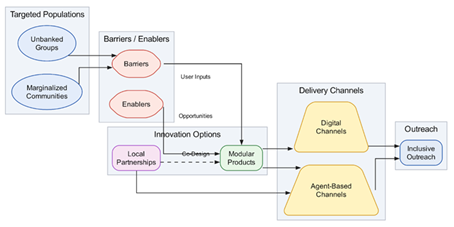

At a national levels savings banks still face severe problems supplying financial services to unbanked people at remote and marginalized areas, due to the actual costs of operating traditional structures of branches and the manual process for the opening of accounts. This article develops an integrated approach which can systematically identify potential pathways for delivering low-cost microloans, savings products and micro insurance to disadvantaged groups. Through integration of a delivery analysis framework, product adaptation theory and mechanism of policy diffusion, the model demonstrates that harmonized account structures, cross-platform digital delivery, modularized products, and agent partnerships together can reduce the cost of delivery and expand access. Based on a thorough review of best practices and policy recommendations, the model assesses suitability, affordability and access by type of financial product in various conditions. It makes explicit to stakeholders the trade-offs that necessarily arise between the effectiveness of outreach and the investment of resources, and thus has the potential to offer decision support for banks to assist practitioners in thinking through feasibility across banking systems. The key novelty is a generic framework that is configurable and enables financial service providers, government and NGOs to be able to plan, assess and implement strategies that might accelerate financial inclusion and ensure the realization of affordable service access for the under-served.

Article Details

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.